In a new report, Automotive Copper Demand 2024-2034: Trends, Utilisation, Forecasts, IDTechEx forecasts that automotive copper demand will reach an annual demand of 5MT (1MT = 203.4 billion kg) by 2034. Autonomous driving and electrification will drive today’s demand, but the component that will dominate demand will continue to be wire harnesses.

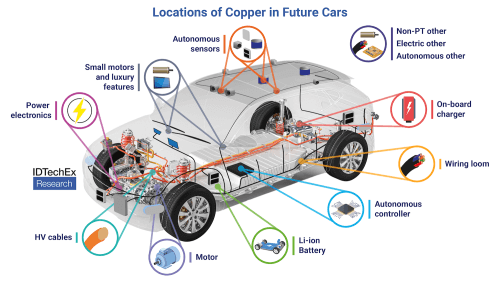

Copper’s place in an electric vehicle with sophisticated autonomous sensors. Source: IDTechEx

Automotive megatrends will drive copper demand at a CAGR of 4.8% through 2034, but wire harnesses will remain dominant

Wiring harnesses are the central nervous system of a vehicle, connecting all sensors, actuators, lights, etc. to the vehicle’s brain. Each component in the system requires multiple wires for communication and power. Today’s vehicles are so complex, containing hundreds of wired components, that wiring harnesses have expanded to thousands of individual wires totaling kilometers in length.

Some players, such as Tesla, are working to optimize the vehicle’s network by reducing system redundancy, kilometers of cables, and kilograms of weight per vehicle. This can be helped by system architecture changes.

Tier 2 suppliers such as NXP foresee an emerging regional architecture approach where wired components are grouped by location rather than function. This helps eliminate redundancy in the wiring harness, but IDTechEx has heard from industry participants that taking full advantage of zone architecture requires more of a harness-first mindset than an afterthought to wiring.

The wiring harness industry has been experimenting with replacing some of the copper wires, such as replacing them with aluminum wires, smaller gauge 48V systems, and even wireless communications, to name a few, all to reduce copper in the wiring harness. These reductions have been offset by the increased complexity of vehicles and the growth in overall vehicle size as larger SUVs become more popular.

But why is copper demand increasing instead? Electrification will be the biggest reason for the increase in automotive copper demand. Copper is used throughout the electric vehicle powertrain, from the foils in each cell of the battery to the windings of the electric motor. In total, each electric vehicle can generate more than 30kg of additional copper demand.

As with wire harnesses, copper demand in electrical components will also change. Future lithium-ion chemistries and technologies will have an impact on the copper strength of batteries, with higher energy batteries typically returning lower kg/kWh copper strengths. In motors, IDTechEx has recently adjusted its interest in permanent magnet non-magnetic motors due to fluctuating neodymium prices. Winding rotor synchronous motors are an example of where permanent magnets are effectively replaced by copper electromagnets, almost doubling the copper strength compared to conventional permanent magnet motors.

Advanced driver assistance system (ADAS) features and autonomous driving are becoming more of a trend and will generate more demand for automotive copper. These systems rely on a suite of sensors, including cameras, radar, and lidar. Each of these adds additional wiring to the vehicle and uses copper in its internal circuit board. While the copper per sensor is relatively small, typically slightly more than a hundred grams, the total amount of copper totals several kilograms for highly automated vehicles with dozens of sensors.

For example, Waymo vehicles have a total of 40 sensors total which is not uncommon for other robot taxi companies.IDTechEx says that while these highly automated vehicles will account for a small fraction of car sales by 2034, widespread adoption of Level 3 technologies over the next decade will be a key driver of copper utilization of ADAS and self-driving features.

Copper Surplus Forecast to Disappear. Bloomberg reported that the copper surplus projected through 2024 has largely disappeared and may even push the market into deficit.

In the past two weeks, one of the world’s largest copper mines has been ordered to close in the face of fierce public protests, while a series of operational setbacks have forced a leading mining company to slash its production forecasts.

Analysts said the sudden cancellation of about 6 million tonnes of expected supply would move the market from a large expected surplus to a balance, or even a deficit. It’s also a big warning for the future: Copper is a base metal needed to decarbonize the global economy, meaning mining companies will play a key role in facilitating the shift to green energy.

The Panamanian government ordered First Quantum Minerals to cease all operations at its $1bn copper mine in the country. Anglo-American will cut production from its copper operations in South America.

Post time: Jan-09-2024